Walmart's New Toy: SBL

Shares of Symbol Technologies (SBL) got hammered last year after product-planning missteps, lawsuits, and accounting delays forced management out the door.

Shares of Symbol Technologies (SBL) got hammered last year after product-planning missteps, lawsuits, and accounting delays forced management out the door.Which makes Symbol one heck of an interesting turnaround play.

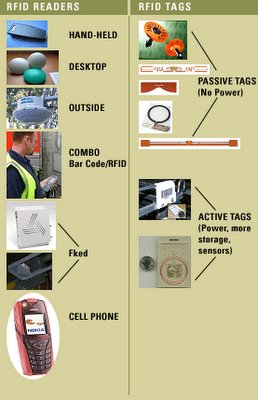

Symbol makes bar code scanning equipment; its niche is RFID technology, the most cutting edge technology permeating the retail arena today.

Walmart (WMT) is already using RFID to maximize its customer relationship management and supply chain systems.

As other retailers and governmental entities allocate more of their budgets to RFID (its data capture technology enables retailers like Target to better control inventory as well as study consumer behavior), we believe that shares of Symbol will enjoy considerable upside.

SBL hasn't hit its earnings estimates once this year, which has kept the stock in a tight trading range.

While the stock trades at a whopping 85 X earnings, SBL's debt-free balance sheet and strong product line may help resuscitate the company out of the coma its former execs put it in.

If Wall Street is overdiscounting the restructuring risks -- and cash flow remains robust -- we see SBL's products becoming more ubiquitous and shares breaking $15 in 2006.

<< Home