When Incumbents Falter: GOL

On Wednesday, we wrote favorably about Gol (GOL), a low cost, low fare airliner that flies people all over Brazil.

On Wednesday, we wrote favorably about Gol (GOL), a low cost, low fare airliner that flies people all over Brazil.They've got first mover advantage and 28% of their market. And they're profitable.

The stock's hitting one 52 week high after another, and shares are up 12% since we put a buy sticker on it.

We've been informed that Gol's prospects could be "tainted" by the following Bank of America news, sent to us anonymously:

"......the real has weakened from 2.21 to 2.34 versus the USD. Merrill just released a forecast for the currency to weaken to 2.65 by Sept/06 on election uncertainties and interest rate cuts. BofA see the currency weakening to 2.45 by mid 2006 on the same forecast of events next year. If the real does weaken by that much, that would make Brazilian ADR's less attractive due to the fact that the conversion will make returns less....."We think the key driver in the airline revival will be fuel costs.

Specifically, where Gol is concerned, we think the company is really onto something unique -- follow closely.

In "The Innovator's Solution," Clay Christensen isolates two types of disruptive innovation in business: low end disruption and new market disruption.

Low end disruption refers to new lower cost offerings to existing over-served customers, typcially the shoddy end of another company's customer base.

Incumbents gladly shrugg it off, then pay the hefty price when the challenger's technology improves and they start masticating into the incumbents' primary markets from below.

Think of termites taking down a mansion.

New market disruption occurs when the challenger rolls out a product/service mix hitherto unavailable.

Maybe the service/product was available, but it was grossly inconvenient to customers -- whatever the case may be, the challenger creates an entirely new market.

Think of online brokerages like E*Trade (ET) or Schwab (SCH) -- they turned students into stock jocks -- that's new market disruption epitomized.

Gol is drawing people through price (low end capture), but also getting people who'd never fly cross-country to pack their bags for the 60 minute trip to Rio (new market).

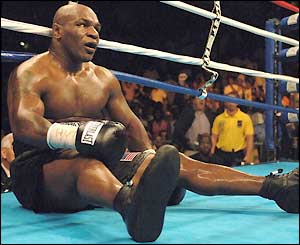

Gol has Brazil in a headlock -- but it could come in for a hard landing if it's expansion plans go sour or fuel abruptly spikes.

<< Home