Playa' Hating: Gamer Feels the Burn

Rocker Partners, a New York hedge fund, thinks Take-Two Interactive (TTWO) is using accounting gimmickry.

Rocker Partners, a New York hedge fund, thinks Take-Two Interactive (TTWO) is using accounting gimmickry.The notarious short selling fund thinks that the company had been selling products to itself, then recording those sales as part of its revenues.

They're not the only ones hating on the gamemaker.

Some 20% of Take Two's freely traded shares are still sold short. Several firms have raised questions about Take Two's balance sheet.

Recently, Bank of America reported that while Take Two has reported $95 million in net income over the past four quarters, it has generated just $6 million in cash flow from operations.

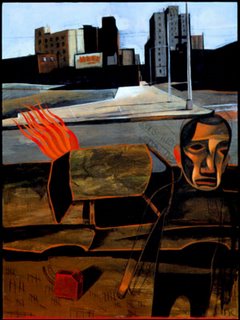

What a way to end a horrendous year for the maker of the hyperviolent (but addictive) "Grand Theft Auto" game.

Major game publishers had a rocky 2005 due to an industry-wide hardware transition, lacklustre title releases, and sharply lower consumer spending.

Even while Take-Two's value is largely defined by the Grand Theft Auto franchise -- and the shorts have turned the company into their personal punching bag -- we're not counting TTWO out, yet.

Grand Theft Auto was inarguably a seismic cultural event.

In the long term, video games should generate plenty of upside --games aren't going away, and publishers are furiously pursuing your kid's allowance.

If only insiders would spend less time dumping shares and more time getting the company's value propostion together, TTWO might have a chance.

Until then, this is the sort of stock that could leave you crying in your beer.

<< Home