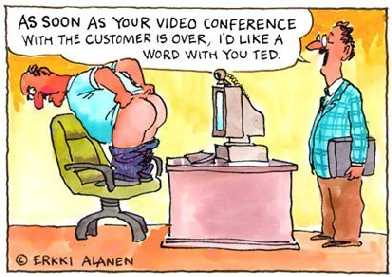

Video Conferencing is Radvision's Niche

When young, unknown companies abruptly sign major contracts with the US government, it's a good sign.

When young, unknown companies abruptly sign major contracts with the US government, it's a good sign. Shares of Radvision (RVSN) are up over 60% since we brought you the stock at $12 on September 10:

Israel-based Radvision specializes in video conferencing services and equipment. If The Jetsons are any predictor of what the future will really look like, we should be buying RVSN right now.Do anything, but whatever you do, don't sell this stock.In addition, Radvision just struck a deal with the Pentagon, who is revamping its networking systems and included Radvision among the few lucky companies contracted to coordinate the military's communications & IT efforts abroad.

..we were pleasantly startled by Radvision's squeaky clean balance sheet. Radvision has $100 M in the bank and no debt. We see revenues topping $70 million this year and jumping to $100 million in 2006. With only four analysts covering the stock and just 20 M shares outstanding, Radvision could pop on even the faintest of news. Trading at just 5 X sales (industry trades at 8 X sales), Radvision and its growth prospects are too hard to pass up, in other words. We forsee double digit growth and possibly, a takeover deal.

...just this week we learned that Hewlett Packard (HPQ) has made a splash in the videoconferencing space vis-a-vis its $500,00 a year Halo system. This could prompt either Cisco (CSCO) or Nortel to snap up a first mover like RVSN. We're upping our price target to $30, based on projected 2006 EPS of $1, a 25 P/E multiple, and $5 a share in cash.

<< Home