Will Gap See Better Days?

Shares of specialty retailer Gap (GPS) got a nice lift today after Deutsche Bank issued a bullish note stating the clothing chain is in turnaround mode.

Shares of specialty retailer Gap (GPS) got a nice lift today after Deutsche Bank issued a bullish note stating the clothing chain is in turnaround mode.At a first peek, Gap's stock doesn't look all that bad: ROE and free cash flow yields are healthy, and we like how debt's gradually being wiped off the balance sheet.

We'd like to see Gap boost margins and give the Street something to look forward, which is asking a lot given Gap's dire predicament.

There is no doubt product execution at the stores is improving slightly, but something tells us Gap's revitalization is going to take longer than bulls expect. In a word, Gap's brands are deteriorating.

All three of its core brands had a lacklustre 2005. Analysts across the board had one word for us: blah.

Store traffic is down, even as overall consumer spending remains decent; merchandise at Gap is simply not compelling enough to trigger bulk purchasing.

Gap's growing pains reflect a company hitting the maturity point of its life cycle -- we suggest investors look to more specialized retailers for consumer-driven investment ideas.

In the retail space, our favorite contender is Chico's (CHS), which has a stranglehold on the "female/35 & older" apparel niche and spits out 22% operating margins (compared to Gap's 11%). Chicos's also makes better use of its assets and shareholder equity. Not only is Chico's more efficient than Gap, it has much more room for growth -- Gap has 3,000 stores running, whereas Chico's has just 660. Lastly, we're big fans of Chico's new concept line, Soma, although we can't say we wear the stuff ourselves.

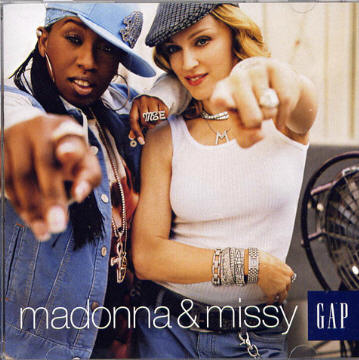

As far as Gap is concerned, don't count on Missy to add a little hop to this not so hip stock.

<< Home