At $77, Merrill Lynch Is A Gift

We are initiating coverage on brokerage behemoth Merrill Lynch (MER) with a strong buy recommendation and a $100 price target.

We are initiating coverage on brokerage behemoth Merrill Lynch (MER) with a strong buy recommendation and a $100 price target.We have a positive fundamental outlook for the investment banking industry and we believe valuations are too attractive to pass on. Our feeling is rooted in improving economic conditions, breaking-out-like-wildfire M&A activity, and improved investor confidence across the board.

We feel that bank multiples are depressed due to concerns related to the flattening yield curve, and that investment banking stocks will rebound to fresh highs sooner rather than later.

We like Merrill for its dominant brokerage business, as well as its great exposure in the M&A category. Merrill’s private client group runs circles around its competitors. At the end of 2004, Merrill had about

14,100 private client advisers in about 640 offices with $1.3 trillion in total assets under their belt. The banking division, meanwhile, ranks among the largest debt/equity underwriters year in, year out.

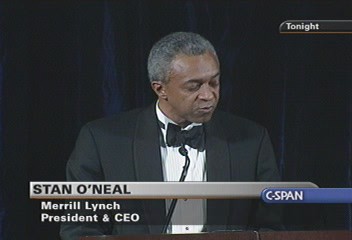

Management gets good grades, as well. Under current CEO Stanley O'Neal, Merrill has made some dramtic cost cuts (such as giving 9,000 unproductive brokers the pink slip), and recently spun off its investment management arm to Blackrock (BLK), a decision we feel will enable Merrrill to focus once more on its core competencies. Under its previous CEO, Merrill became a slow moving giant lacking both focus and accountability. Although insiders own a small amount of the shares outstanding, we feel Stan O'Neal's stake in the firm (3M shares) -- as well as his aggressive, no-nonsense approach -- should keep him on his toes.

At less than 12x forward earnings, Merrill is a steal. 12x is a shocking discount to the S&P 500, the firm’s peer group, and Merrill’s historical P/E. We are also recommending Goldman Sachs (GS) and Lehman Brothers (LEH), and those reports will follow in due time.

<< Home