A Real Blood Bank: Lions Gate Films

Lions Gate Films (LGF), the independent filmed entertainment studio, is on a roll. Now, due mainly to another October gorefest, it looks like the remainder of 2006 will be just as promising. Here's a quick look at what Lions Gate has to offer both movie buffs and investors.

Lions Gate Films (LGF), the independent filmed entertainment studio, is on a roll. Now, due mainly to another October gorefest, it looks like the remainder of 2006 will be just as promising. Here's a quick look at what Lions Gate has to offer both movie buffs and investors.Overview LGF owns a prolific library of more than 5,000 titles, an invaluable treasure trove and source of recurring revenue. Today, the Lionsgate brand stands for original and starkly daring entertainment. According to Travis Johnson, Lions Gate proffers a "a very diversified product offering" along with a "new kind of thinking." Its "creative use of excellent stories" makes Lionsgate a special company, one that is "willing to exploit any niche." These niches "all have ready-made audiences who can be relied upon to pay to see the movie, and they are generally cheap to make."

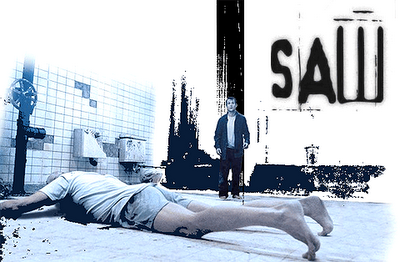

Thanks in part to Lionsgate, moviegoers around the world have once again fallen in love with blood and gore. Hostel, which was just released on DVD, was hailed by many as "the scariest horror movie of 2005." Blending extreme violence, transgressive sex, and cinematic panache, Hostel is a must-see for aficionados of the genre. Best of all, LGF just announced that Saw 3, the next chapter in the uber-disturbing horror franchise, will begin filming on May 8th in Toronto. The film is scheduled for a Halloween 2006 release. If you haven't seen Saw or Saw 2, be warned: the movies are quite visceral -- and explosively profitable.

The Saw franchise is emerging as one of the most inventive and popular franchises in the horror genre, coughing up worldwide box office grosses of over $250 million and DVD sales approaching 10 million units. Saw 2 set a Lionsgate record with a three-day opening weekend of $32 million last Halloween, becoming the widest release in Lionsgate history and achieving one of the best opening weekends ever for a horror sequel. With a domestic box office of over $87 million and more than $152 million in worldwide theatrical box office, Saw 2 quickly surpassed the $55 million domestic box office total of the original Saw.

We believe that Saw 3 will be a screaming #1 weekend smash -- investors looking for a short term play on the resurgence of the horror genre should pick up shares of Lions Gate Films, which will meet with analysts on May 10. Management has already cut 2006 guidance several times, so if any of their upcoming 2006 releases surprise, the stock could easily cruise back to its 52 week high. In sum, it appears that the worst has already been priced into the stock.

Risks The media business is notorious for generous cash flows. However, the film & entertainment segment is our least favorite way to play media stocks, primarily because its fortunes are tied to hits or flops. Additionally, an excessive amount of the profits generated lands in the hands of movie stars, who demand bloated payments for their services. LGF has 8 times as much debt as it has cash and operating margins are abysmal. Short interest on the stock seems to be increasing. Depending on how you view shorts (we read them as contrarian indicators), this could signify that the odds are heavily stacked against LGF. Lastly, we're turned off by management's reluctance to cozy up with analysts -- though there are legitimate reasons for insiders to shun aggressive, short-attention-spanned analysts, nine times out of ten we prefer as much transparency as we can get.

Valuation LGF is still losing money, so valuing the stock on a multiple basis is problematic. On a price/cash flow basis, then, LGF trades below its peer group. We like how LGF has boosted its top line immensely over the last few years (revenues more than doubled to $842M in 2005), but we look forward to the day when the firm can show the Street sustainable bottom line growth. As long as LGF can continue to balance its home release-driven revenues with those coming from its theatrical releases, we'd feel comfortable picking up shares.

The Bottom Line LGF took home the Oscar for Crash, a cornucopia of race-inflected vignettes and a grimly realistic tale of human relations. If this entertainment company bombs with Saw 3, the only thing crashing will be the stock. On the flip side, a revenue beast like Lions Gate could easily become an acquisition candidate if profitability continues to evade the company. However, betting on a buyout isn't always as good as it sounds: a robust box office schedule throughout 2006 should be enough to motivate one to pick up shares, which we think could hit $13 by Labor Day.

<< Home