Initiating Coverage on LifeCell with a Hold

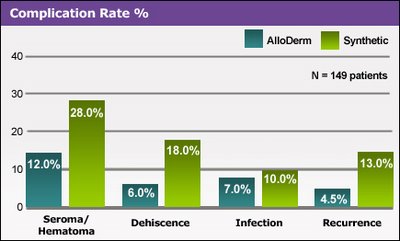

New Jersey-based LifeCell (LIFC) markets products made from human tissues that are used in surgical procedures, particularly the reconstructive, urogynecologic and orthopedic surgical spaces. Lifecell's patented technology produces a unique regenerative human tissue matrix that provides a complete template for the regeneration of normal human tissue. LifeCell's blockbuster product is called AlloDerm, a dermal matrix made from human skin that is used in grafts. The doctors we spoke to Thursday night have told us that Alloderm is a "hot product" whose "growth is bound to explode further."

New Jersey-based LifeCell (LIFC) markets products made from human tissues that are used in surgical procedures, particularly the reconstructive, urogynecologic and orthopedic surgical spaces. Lifecell's patented technology produces a unique regenerative human tissue matrix that provides a complete template for the regeneration of normal human tissue. LifeCell's blockbuster product is called AlloDerm, a dermal matrix made from human skin that is used in grafts. The doctors we spoke to Thursday night have told us that Alloderm is a "hot product" whose "growth is bound to explode further."Today's 8% selloff represents a terrific buying opportunity, we think. Below are some of the key drivers we believe will catapult the stock further, potentially into the mid to late $30's by Labor Day:

1) Lifecell's products are differentiated and spread out over a plethora of different clinical applications. Such diversification cushions the negative impact shares could experience after unsuccessful product tests, always a vertiginous risk in the medical technology space.

2) The potential for LifeCell to penetrate the breast augmentation category is huge. In 2005, approximately 290,000 breast implant procedures took place -- a $75 million market, at least. Lifecell's current penetration in the breast reconstruction space is 25%, leading us to believe that significant upside exists. Lifecell is currently running tests to study the degree to which Xenoderm/Alloderm can mitigate capsular contractions (namely, scar tissue) associated with breast implant surgery. Further data findings should bode well for the stock, as well as enable the firm to crack open international markets, where end market demand is high but depressed by contamination fears.

3) Only 6 analysts follow LifeCell. A deepening socio-cultural obsession with physical perfection and aging bodies should force more brokerage houses to start coverage on niche players such as Lifecell, which generated $105M in sales last year through its 269 employees. Lifecell's current market cap is less than $1B, making it impossible for some portfolio managers/analysts to buy or cover the stock. With a $1B+ market capitalization, LifeCell should definitely grab more attention from the investment community at large and possibly instigate a new buying wave.

4) LIFC is growing its EPS at a 50% clip. Our back of the envelope calcs show Lifecell earning $.65-$.68 EPS in 07 off $165-$170 million in revenues. Applying a conservative 40 x multiple (premium to industry mean multiple), we arrive at our $28 fair value for shares. We add $4 to our price target based on the stock's a) takeover appeal and b) enviable cash position ($43M in cash with zero debt). Our short term price target is $32 dollars and would consider pullbacks like today's especially enticing; we urge investors to HOLD onto this security.

Risks/Conclusion We are incredibly enthusiastic about Lifecell's prospects, but would warn readers to a tight 33M float and 16% short interest. We expect significant volatility as a more competitive milieu materializes and Lifecell unloads new data findings on the medical community. However, deeper penetration into the breast enhancement area and continued success in the hernia market should send the stock to fresh highs, as well as attract attention from rival firms aiming to grow horizontally, supplier firms interested in vertical growth, and an analyst community overwhelmed by LifeCell's high margin portfolio (22% operating margins and 13% net margins).

Don't forget that you can also catch our recognized work at SeekingAlpha.com, a must read according to the New York Times, Reuters, Forbes, CNET, and Barron's.

<< Home