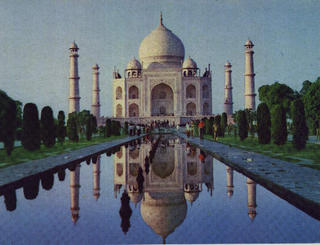

The Rise of India (and Its Banks)

A lot of smart money seems to end up in India nowadays.

India is an epicenter of FDI.

Foreign direct investment for some of you.

That's when a domestic corporation takes a controlling stake in a foreign company.

As far as I'm concerned, you'll be seeing a lot of this over the next 5-10 years.

Here's why.

India: The Next China?

China's economy already took off.

Now India is following suit.

India's arrival as the developed world's biggest back office already spurted the IT boom.

Companies like Infosys and Satyam have rewarded investors handsomely, share prices tripling and then some.

Then the outsourcing backlash here at home put a halt to the party.

Robust growth in other sectors such as manufacturing consumer goods are catapulting GDP growth off the meter.

A widely quoted report by Goldman Sachs says India will eventually become the world's third largest economy after China and the U.S by 2011, equaling and then surpassing China's.

India's population also will likely pass China's.

But India is still largely an entity of me-no-have.

Average per-capita income is $500 a year.

About 35% of the population live in poverty.

But as China did, India's government is making strides to improve creaky infrastructure and privatize government-dominated industries.

India's stock market rose about 80% in 2003.

Part of that was a result of India's foreign exchange reserves touching $30 billion in the last year to $100 billion, leading Moody's to upgrade India's long-term foreign currency ratings to investment grade for the first time.

Huge!

Job growth in tech services is already fueling a rapidly growing consumer class--sales of autos, computers and cell phones are balooning.

The wise investors would be looking at the suppliers who are benefiting from such mass expansion.

For example, diesel engine maker China Yuchai -- they supply all the engines for the buses everyone rode to work.

Indians are ditching their bikes and riding the bus.

But enough about buses -- let's talk about banks.

Indian Banks: Takeover Candidates?

Part of the modernization process is the rapid proliferation of a banking system.

Think about it--people want to build--they have to borrow money.

Banks lend--it's what they do.

Now, changes allowing greater foreign ownership to help rescue India’s crippled private banks are resurfacing.

Up until now, 2 factors were hindering bank consolidation in India.

Nearly 80% of the market used to be out of limits for acquirers because foreign direct investment in the 27 giant state banks couldn't exceed 20%.

Here's the kicker.

Recently, the rules restricting foreign ownership in Indian private sector banks were eased, raising hopes of consolidation among India’s 32 private banks.

Foreign banks could now possess up to 49% of a private bank.

Cha-ching!

A Merrill Lynch research report published in 2002 hailed India’s banking sector as one of the most distraught in the locale – with nearly 80 of the 97 banks having a market share of less than 2%

That's begging for an M&A visit.

Conclusion

Clearly, India is opening up.

India's "unwieldy democratic government" -with its socialist ethos - has gradually loosened up and eased regulations.

Doors are opening to foreign investors.

The seismic transformation of an agricultural and cash-based economy to a sizzling service economy driven by the middle class should serve investors well for a while more.

<< Home