Follow Up: SunTrust Bank

On September 6, we recommended to our readers that they buy shares of Southeastern regional bank SunTrust (STI).

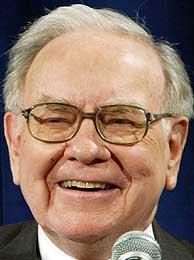

On September 6, we recommended to our readers that they buy shares of Southeastern regional bank SunTrust (STI).The Atlanta-based bank caught our attention after the Oracle of Omaha himself - Warren Buffett -- bought a large block of shares in the company.

That was one catalyst; another one was the increased demand for mortgages and loans attributable to record low interest rates.

Even with rates climbing and Mr. Greenspan's jihad on American homes, STI was booking loans and operating efficiently.

But the real reason we liked Suntrust was location.

Suntrust is a growing player in a sizzling environment, namely Florida.

Banks are making money hand over fist in Florida since more wealth is flowing into the sunny state than ever before.

In addition, construction is running rampant -- for banks, that's good news.

After the SEC hit STI with a notice over the summer, shares dropped.

At that point, we swopped in, assessed the damage, and decided STI was going higher.

On Wednesday, the market confirmed our feelings from 6 weeks ago as STI reported robust numbers and consequently, investors bumped shares higher.

SunTrust posted a 39 percent jump in third-quarter profit.

Net income rose to $510.8 million from $368.8 million a year earlier.

Revenue for the latest period climbed 32 percent to $2.01 billion from $1.52 billion.

<< Home