Welcome to the (Amazon) Jungle

If you were roaming through the Amazon (AMZN) on Wednesday, you were probably slaughtered and mauled by bears.

If you were roaming through the Amazon (AMZN) on Wednesday, you were probably slaughtered and mauled by bears.Investors unloaded and punished shares of the online book retailer after AMZN reported a 44% drop in 3Q income.

Once again, promotions were the culprit.

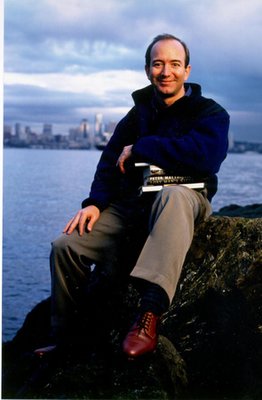

Amazon CEO Jeff Bezos has them (promos) on autopilot -- and as we've mentioned several times -- they're killing the company.

We recommended shares of AMZN (as a short term play) earlier this year.

Nowadays, bullish sentiment on Amazon has dried up -- a recent search found that only the Fool.com sees any light at the end of Amazon's tunnel.

Don't get us wrong -- 1999's Time Man of the Year is a genius -- but the Amazon party is over.

Anthony Noto at Goldman Sachs recently nailed it on the head when he said that "deteriorating profitability reflects the fourth consecutive quarter of 20%-plus year-over-year growth in marketing expense and the largest y/y absolute increase in tech costs ever."

Is Amazon a business you want to be a part of?

What AMZN needs is a long term strategy -- one good quarter won't cut the mustard any more, Jeff.

Amazon's Fall represents a common Wall Street dilemma, namely, that it's almost impossible for companies to simultaneously please investors and customers.

In AMZN's case, shareholders are getting the short end of the stick whenever users partake in AMZN's large discounts; the promotions are obviously beneficial for book lovers, but they're eating into profit margins.

Shares are richly valued and AMZN's growth projections look bleaker than most analysts want to admit.

In short, it's best for investors to steer clear of the Amazon -- the animals there want your blood.

<< Home