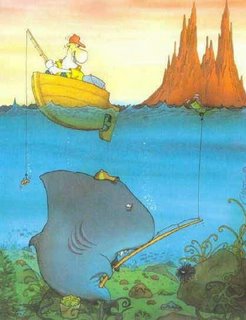

Fishing for Value: Goldman's Cheap

With rate hikes expected to pause in 2006 and the Fed jihad nearing a close (lest Bernanke should hike rates when he lands in office just to show the Street he's no playground wimp), it should surprise no one that the financials are rallying.

With rate hikes expected to pause in 2006 and the Fed jihad nearing a close (lest Bernanke should hike rates when he lands in office just to show the Street he's no playground wimp), it should surprise no one that the financials are rallying.Too bad expectations for the industry are so high that stalwarts like Goldman Sachs (GS) have to watch on as its shares get hammered.

Goldman at these levels is a travesty.

Goldman is still trading at a below-industry multiple and continues to underwrite new issues for America's hottest companies, like this month's explosive Under-Armor IPO (watch out Nike).

Goldman's footprints are in every solid financial service space conceivable.

We hope the Street wakes up and realizes that Goldman is on sale here at these levels.

Could GS be worth 20 X earnings and at least 3 X book? We think so.

At that point, GS will be valued where it was when it went public in 1999.

The writing is on the wall -- experts are predicting that deal flow and M&A in 2006 will break out like wildfire.

Goldman's a $150 stock in 2006. Easily.

<< Home