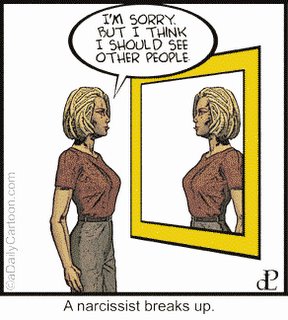

The Mirror Stage: Citigroup

Sam Walton once wrote : “Being big poses dangers. It has ruined many a fine company who started out strong and got bloated or out of touch or were slow to react to the needs of their customers.”

Sam Walton once wrote : “Being big poses dangers. It has ruined many a fine company who started out strong and got bloated or out of touch or were slow to react to the needs of their customers.”Geese, remind anyone of Citigroup (C) ?

We have a position in Citi so we'll be all ears later this morning as Citi reports Q4 earnings.

So far this week, the banks have reported both good and bad news: JPMorgan's recent quarter didn't impress analysts one bit, but Merrill Lynch's did -- in fact, Merrill ripped the cover off the ball.

So it's hard to predict exactly where Citi will fall, especially in our inverted yield curve environment.

Making a case for Citi is difficult -- it doesn't seem to undervalued or overvalued. It's just, well, there.

We own the stock because we think Citi's a profitable, cash-generating giant with a decent dividend yield.

More compellingly, Citi may be breaking up into four seperate entities.

A breakup could enable this banking behemoth to distribute hidden value among shareholders.

Citi's units would be much more effective competitors as smaller, focused players than they are now. Leaner management structures and greater strategic focus would be other byproducts of a breakup.

But those could be pipe dreams for all we know.

Until Citi's beauracratic ethos evaporates -- or that breakup is announced -- we don't see much upside coming from Citi.

Nevertheless, its as stable a global play as you're going to get -- Citi is everywhere.

<< Home