Spirits Leaders Look Compelling

Visit any college campus and see for yourself: Beer's out and premium branded spirits/wine are in. Here's a quick look at three of our favorite pure alcohol beverage plays. On deep pullbacks, we'd easily add these names to our portfolio.

Visit any college campus and see for yourself: Beer's out and premium branded spirits/wine are in. Here's a quick look at three of our favorite pure alcohol beverage plays. On deep pullbacks, we'd easily add these names to our portfolio.Brown Forman (BF.B) The guys behind Jose Cuervo have been at it over for 130 years, so they're obviously doing something right. We admire the way the firm that's been peeling off its non-liquor related businesses to boost sales of premium spirits. Volume figures for Jack Daniels were off the chart in 05, a clear sign of the paradigm shift we're seeing in the alcohol space in which consumers are willingly "trading up" to deftly-marketed goods. Brown rewards shareholders with buybacks and dividends, shareholder-fueled activities we think will continue even as the name continues its acquisition behavior. Insiders own most of the stock (the float is only 37M shares vs. 122M shares outstanding) and Brown's balance sheet gets a passing grade -- debt accounts for approximately 30% of its total capitalization.

Constellation Brands (STZ) Constellation is the largest winemaker in the world. Half of its sales come from that category, the other half coming from spirits and beers (like Corona). Although this is another firm where the founding family has virtually made it impossible for outside ownership to manifest, we like how Constellation has rapaciously acquired leading brands (like wine juggernaut Mondavi in 05) and broadened its portfolio holdings in order to make itself more marketable to suppliers. Analysts think the distribution networks in this space could shrink, so a variegated product company like Constellation could enjoy a competitive advantage. We only wish the firm was less leveraged -- the firm has $3B in debt but just $30M in cash.

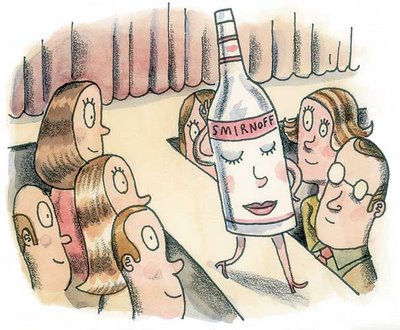

Diageo (DEO) This is the top pick of the three, we think. Diageo is the child of a massive merger between Grand Metropolitan and Guinness and it now holds almost half of the top 20 spirits brands in the world (top brands include Tanqueray, Smirnoff, Bailey's and Johnnie Walker). Besides such impressive market visibility, Diageo has been expanding in places like Brazil, India, and China while maximizing value from its established core markets. Diageo uses its free cash flow to axe debt and we're confident this name could be an overlooked play on the ever popular emerging markets motif. We'd be amiss in not warning readers how vulnerable Diageo's products are to taxation surprises, so be on the lookout for those. Diageo over $8M in debt that it must pare down and we'd feel more comfortable if insiders owned more of the stock. All that said, with 27% operating margins, Diageo is a business we'd like to own should the stock ever suffer a violent selloff.

Don't forget that you can also read most of our research over at SeekingAlpha and if you're a paying client, via PDF weeks before it appears on this site.

<< Home