Big Waistlines = Bigger Profits: WTW

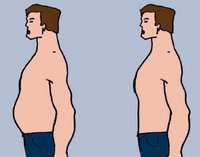

As many as 300,000 to 400,000 Americans die from obesity related causes yearly, giving plenty of opportunity to companies like Weight Watchers (WTW), which has made a fortune providing weight loss products, to service individuals looking to enhance their lifestyles, build self-confidence, and get in shape. Weight Watchers reports earnings later today and we just had to ask ourselves: how healthy is the stock?

As many as 300,000 to 400,000 Americans die from obesity related causes yearly, giving plenty of opportunity to companies like Weight Watchers (WTW), which has made a fortune providing weight loss products, to service individuals looking to enhance their lifestyles, build self-confidence, and get in shape. Weight Watchers reports earnings later today and we just had to ask ourselves: how healthy is the stock?Overview Weight Watchers is the leading provider of weight-loss services. It operates in 30 countries, where the firm conducts weekly meetings that provide customers with advice and support. It also sells a range of food products, receives royalty revenue from its franchisees, and licenses its unmistakable brand. Weight Watchers' online platform is doing much better than we expected. Online membership increased in 2005; as high margin area for WTW, customer segmentation via the internet channel will be a critical growth area for the company. Lastly, Weight Watchers recently announced the initiation of a quarterly cash dividend. Now, investors can get paid to wait as the company improves its overseas operations and beefs up its online services.

Valuation WTW puts up some great numbers: operating margins, returns on capital, and free cash flow-to-sales over the last 5 years have averaged 30%, 31%, and 19%, respectively. Thus, we think WTW deserves to trade at a premium to its peers. Currently, analysts think the firm can grow its earnings 18% from 2006 to 2007. However, the stock only trades at 18.5 x next year's numbers -- we think WTW should trade for at least 1.5 x growth, or a 27 forward multiple. At 27 x our aggressive 2007 EPS estimate of $2.50, we arrive at a $67 price target, well above where the stock is currently trading.

Risks After an unsuccessful diet innovation plan in the UK market, WTW said that international attendance growth was flat in 2005. Insiders (who don't own very much of the stock, unfortunately) have called this fallout a temporary problem, but we'd dig deeper into the company's strategy before picking up shares. Weight Watchers' programs take Steven Seagal like discipline, so it is not uncommon to see members pump themselves up on another fad diet promising overnight results only to quit a week later. This sort of aberrant customer behavior is always a risk to keep vigil over. Lastly, WTW faces competition from meal-replacement products, dietary supplements/drugs, and simple surgical procedures. Commercial weight-loss program Nutri/System (NTRI), whose stock ripped the major averages in half last year, is a perpetual thorn in the side. Nutrisystem is debt free, spits out 20% operating margins, and should grow its earnings 40% in 2007, according to our estimates. Although insiders have been selling, we see shares of NTRI hitting $80 inside the next 90 days.

The Bottom Line The population of overweight/obese people is increasing in leaps and bounds. As a result, demand for weight-loss solutions has exploded, making the weight-loss industry a virtual gold mine for investors. In the US alone, two thirds of the population is considered overweight, while about one third is considered obese. The current weight-loss market in the United States to be $40 billion and WTW is sitting right in the middle of it. The firm has a proven system and brand visibility its rivals could only dream of. Improving trends in Weight Watchers' critical North American market, which encompasses more than half of total attendance, should continue to drive the top line story. We expect that the heavier weight trends among the population and the company's dual decision to stick to its core business model while ramping up newer payment methods (to improve user retention) will serve the company well. At current levels, we're incredibly tempted to pull the trigger.

How many times do we have to bash it in your head? Catablast! Media is part of the SeekingAlpha Network, the most dynamic force on Wall Street today, hands down. SeekingAlpha has been recommended by Barrons, New York Times, Wall Street Journal, Forbes, and Financial Times, to name a few.

<< Home