Univision Receives Buyout Offer Late Wednesday

A private investor group is offering about $10.7 billion to acquire Univision Communications (UVN), the nation's second largest Spanish broadcaster.

A private investor group is offering about $10.7 billion to acquire Univision Communications (UVN), the nation's second largest Spanish broadcaster.The bid of about $35 per share came from a motley crew of private equity big names: Madison Dearborn Partners, Thomas H. Lee Partners, Providence Equity Partners, Texas Pacific Group, and media millionaire Haim Saban all got a piece of the action.

Regrettably, shares of Los Angeles-based Univision tumbled more than 4 percent Wednesday on news of the offer, most likely because this news has been factored into the stock for months and because the price tag was truly pathetic -- $35 a share? Where's the shareholder value in that? We think these fat cat buyers should cough up at least $42 smackers for UVN. Univision's flagship station is the 5th largest TV network in the US and controls a young adult audience 3 x the one controlled by MTV. Univision is also your pure play on the telenovela (Spanish soap opera) boom: 2/3 of all US Mexicans watch at least one telenovela per day. UVN's ruthless management and wide moat business have transformed it into a media leviathan. Long term investors deserve to be amply rewarded.

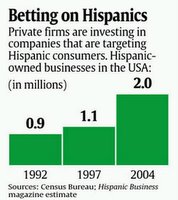

There's no need for us to iterate the reasons why we like Univision, namely because we already did in a positive report we published back in March. As we argued then, Univision is a compelling proxy on a mushrooming demographic that's ready to spend its newfound wealth.

Don't forget that you can also enjoy our work at SeekingAlpha.com, a must-read according to The New York Times, Barron's, and Forbes.

<< Home