Merck's Courtroom Battles: Sunday Stew

During the 80s and early 90s, Merck (MRK) was the drug stock to own.

During the 80s and early 90s, Merck (MRK) was the drug stock to own.Today, Merck's future is far from certain.

Do you buy at these levels now that a collosal $253 million dollar settlement has been paid?

Or, do you let things pan out for 3 more months as the remaining lawsuits get settled?

One thing is for sure, drug stocks will be moving on Monday.

How many more millions will Merck have to fork over before it can get back to business?

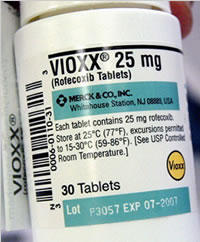

The jury that awarded the settlement found that Merck was long aware of Vioxx's potential heart risks but hid those risks from patients.

The New York Times reported Sunday that:

Over the next few days, lawyers, Wall Street analysts and Merck's own executives will try to explain the company's devastating defeat and to predict what the Texas case means for the thousands of additional Vioxx suits that Merck will face. The answer could determine whether Merck will survive as a strong, independent company or will be crippled for years or even decades.Should trials continue to go against it, Merck faces a basically unlimited pool of plaintiffs.

Merck has said that it plans to take every suit to court rather than offer settlements.

If you still own MRK, what are you thinking?

Do you know that MRK is a company that forced its salesmen to view a marketing videotape training them to view doctors' concerns about Vioxx's heart risks as "obstacles" to be avoided?

A jury spokesperson said that the verdict was not to reward Mrs. Ernst but to punish Merck for its actions.

Job well done.

MRK is clearly in a hole too deep to climb up from and find oxygen.

In fact, it was disclosed in the same Times report that e-mail messages in which Merck scientists discussed their concerns about Vioxx will be allowed in all the upcoming trials.

Regardless of the the fact that Merck did $22 billion in sales and $6 billion in profits last year, the psychological and PR beating they'll withstand over the next year intimidates us.

We're tethered to our earlier Sell rating on MRK shares until the litigation pans out and generic competition ebbs.

(Full Disclosure: The author is long JNJ and Pfizer and sold all remaining MRK shares immediately following the Vioxx crisis in September 2004.)

<< Home