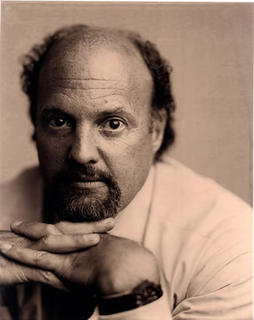

Remembering Cramer in 2000

Our analysts follow Jim Cramer on a daily basis, we won't lie about that.

Our analysts follow Jim Cramer on a daily basis, we won't lie about that.But we take everything he says with a heavy grain of salt.

And so should you.

Energy sells.

It's what makes Cramer such a dynamic personality and arguably one of the best things that ever happened to CNBC.

But let's talk about his stock recommendations.

As a recent study discovered, Cramer is wrong more often than he is right.

With that said, we thought we urge our readers to look up Cramer's landmark article Winners of the New World and see exactly how wrong he was when he was riding that euphoric technology wave in 2000.

So, if you can't own the retailers, and you can't own transports, and you can't own banks and brokers and financials and you can't own commodity makers and you can't own the newspapers, and you can't own the machinery stocks, what can you own? A-ha, that just leaves us with tech. That's why we keep coming back to it. That's why, despite the 80% increase in the Nasdaq last year, we are looking at another record year now. It is by that process of elimination that I have picked my top 10. And my next 10 and my next 10 after. Only those companies are worth owning. The rest? You can have them.Most of his picks in the article tanked, but obviously, they tanked along with the rest of the market.

Only boring, value-driven investors like Buffett (and my broker, who didn't buy one tech stock and stuck to his guns amid my skepticism) walked away from the Bubble burst with minor scrapes and bruises.

Nevertheless, the New Economy rules Cramer underlines in his manifesto were for the most part, sound arguments that proved themselves with time.

When I watch Cramer rabidly dissecting stocks on Mad Money on CNBC , I keep the article in mind.

What makes Cramer Cramer is that he can be both right and wrong -- and get away with it.

<< Home