18 Months: Barr Either Gets FDA Nod or Tender Offer

2005 has been a sweet year thus far for many manufacturers of generic drugs.

2005 has been a sweet year thus far for many manufacturers of generic drugs.Ivax Pharmaceuticals got snatched up by Israeli generic drug firm Teva, no surprise.

Ivax (IVX) CEO Phil Frost promised to increase shareholder value after the stock plummeted in 2000-2001 and that is exactly what he did.

We think Barr Labs (BRL) is the next one to go.

Rivals like Teva and Watson like Barr's lucrative oral contraceptives franchise.

Women's health in general is an attractive, underserved niche.

That's where Barr (coverage initiated on Friday with a Strong Buy Rating) comes in.

They reported numbers on Thursday.

While they weren't bad, they weren't great either.

We think Barr is better off in another company's hands.

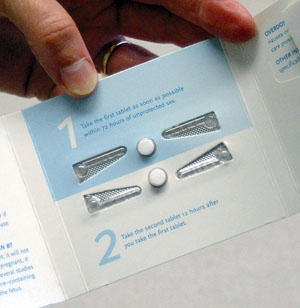

If Barr can get FDA approval for over the counter use of Plan B, other larger firms will give BRL's healthy balance sheet a second look.

As a living, breathing entity, Barr's enterprise value is well worth the taking.

The stock popped off this week after medical researchers found that the morning after pill, as it is called, does not induce abortions.

For too long now, anti-abortion protesters have bullied and walked all over the pill's medical merits.

Scientists assert time and time again that the progestin hormone in Plan B prevents ovulation but "does not affect a fertilized egg, and therefore cannot be considered abortion. "

Ideology should never win over science.

Barr will win this out -- it's just a question when.

We're giving the company 18 months before they either get approval from the FDA, get acquired, or best of all, both.

<< Home