The Bottom Line: The Devolution of Hedge Funds

In their halcyon days, Hedge funds thrived off secrecy.

In their halcyon days, Hedge funds thrived off secrecy.The more enshrouded in secrecy they were, the higher the returns for their investors.

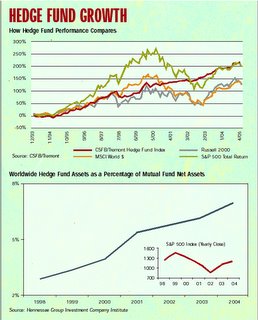

Today, however, hedge fund returns are waning, as measured by the revered CSFB index.

That's because as more hedging strategies have been divulged to the masses, the less key players and fund managers have been able to exploit those strategies and capture market anomalies.

Pure play hedge funds are approaching thier devolution.

One quick illustration: your average mutual fund can short stocks if you want it to.

We strongly believe this will play out into a more serious, long term trend.

There is simply too much money chasing too few good ideas.

Naturally, investors will pursue whatever can give them an "edge."

Right now, the popular path is that which leads to Hedgeville.

Problem is, the more crowded that town gets, the uglier it becomes.

<< Home