First Data Corp: Nuetral

We hit a double with First Data Corporation (FDC).

We hit a double with First Data Corporation (FDC).First Data is a transactions processing heavyweight.

If you've ever wired money to a family member, there's a good chance you've given them some of your hard earned pesos.

First Data is everywhere in the U.S. and overseas as well.

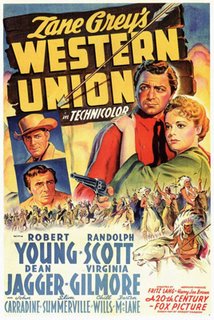

The company's Western Union subsidiary has a global reach comparable to that of Fed Ex, UPS, and the beleagured Walmart.

This cash machine has turned into our own personal ATM as FDC shares have doubled from the $21 price we bought at.

The good news is we think this stock could go to $50.

Don't get us wrong -- there's nothing as banal as money-wiring.

But with Western Union's healthy brand -- and wide moat to ward off intruders -- we believe FDC will continue to generate growth at the expense of rivals who're kept at bay by FDC's high switching costs.

Today, we've intiated coverage on FDC with a rare nuetral since their last quarter left us a bit stumped.

The money-transfer market remains huge, FDC has rolled out major payment processing operations in China, and they've retained their whopping 75% grab of the market.

To add spice to the stew, in mid August investing avatar Warren Buffett picked up 625,000 shares of the stock for his own account.

But, alas, the Street wants more growth.

All that notwithstanding, FDC remains a conservative way to play the Asia boom.

As capitalism expands, so will FDC/Western Union's earnings.

<< Home