Wall St. Goes Main St: Hedge Funds For the Masses

On Saturday, we pondered what it meant for hedge funds to go mainstream.

On Saturday, we pondered what it meant for hedge funds to go mainstream.We concluded and found that:

Our timing was perfect....hedge fund returns are waning, as measured by the revered CSFB index.

That's because as more hedging strategies have been divulged to the masses, the less key players and fund managers have been able to exploit those strategies and capture market anomalies.

Pure play hedge funds are approaching their devolution.

One quick illustration: your average mutual fund can short stocks if you want it to.

We strongly believe this will play out into a more serious, long term trend.

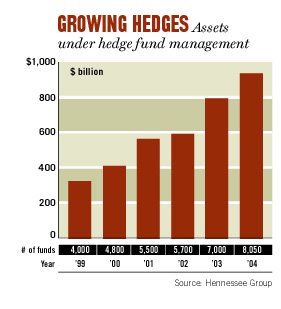

There is simply too much money chasing too few good ideas.

From the New York Post today:

Middle-class investors who dream of the fat returns corporate titans and institutions earn from hedge funds can now wake up to such an opportunity. A European investment company has opened a street-level Midtown office selling hedge fund-like investments opportunities with minimum deposits of just $5,000. The company, called Superfund, opened its doors recently on Fifth Avenue, across the street from the Public Library and doors away from a Burger King and Subway shop.Consider yourself warned.

<< Home