Cruising Along: Royal Carribean Oversold?

We love the smell of panic in the morning.

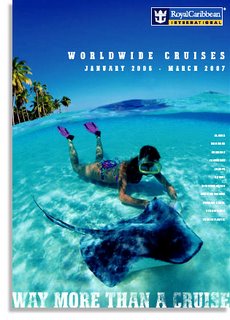

We love the smell of panic in the morning.Royal Carribean (RCL), purveyor of luxurious cruise vacations, has hit a rough patch.

The bad publicity inundating the company right now has sent investors fleeing for the door.

The stock's losing ground but the business keeps on chugging along.

The fact remains that cruising is one of the safest vacations around, and the cruising business -- which is well-defined and averse to new entrants -- is booming.

Despite increasing terrorism fears, the demographics of the cruising industry remain favorable.

Royal Carribean's top line growth has been on a steady upward trajectory over the last 5 years.

They are rapidly expanding their fleet, currently comprised of 29 ships that visit 160 destinations worldwide.

Not one analyst has downgraded Royal Carribean in light of the recent events.

Today's sellers have forgotten that the bad events that occur on cruises are passenger-specific and extremely rare.

We're sellers of leisure related stocks when economics enter the picture -- a weakening economy or increasing fuel prices would certainly force one to think twice about holding on to his or her cruise stocks.

But not when one honeymoon goes tragically awry. That'd be selling on emotion, and that we cannot espouse.

<< Home