Google Crushes $400: $500 Next Stop

Google (GOOG) is the new Amazon.

Google (GOOG) is the new Amazon.We were chided for our optimism, but on Thursday we were proved right.

The search king cruised past the formidable $400 level today.

On Monday, we asserted that Google would pass $400 this week.

On Tuesday, we were hit with a plethora of nasty emails from bears who thought the Google craze was dead.

Google can't die -- its earnings are violently accelerating.

And unlike the aforementioned book retailer (which was still losing money when Merrill Lynch analyst Henry Blodget put a $400 target on it), Google actually makes money -- boatloads of it.

We believe that observant investors see irregularities in prices as profit opportunities.

That's right -- at $396, Google was still cheap.

In case you missed Monday's bullish call:

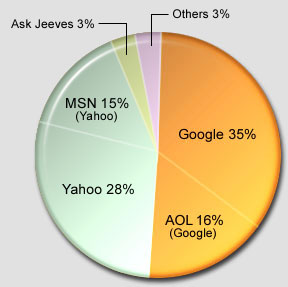

Google will earn up to $9 a share next year. Google shares are up to $396 since we placed a table pounding buy (and $500 price target) on the stock. The online advertising space is growing at the tune of 30% Investors are paying multiples as high as Googles for companies with slower growth. What's more important for investors to look at is not the dollar amount of Google's stock price but what Google's valuation is relative to its peers. And on that basis, Google still looks reasonably attractive, if not dirt cheap. GOOG looks to be the company that deserves the premium right now. It has reported stronger gains in sales and earnings than Yahoo! since Google has more exposure to the online advertising market. Google will break $400 this week and flirt with $500 before we ring in the New Year.One red flag, however: Insiders are selling stock hand over fist.

<< Home