Speculation Fuels Fuel Drink Maker

Investors are always looking for the next "big thing."

Investors are always looking for the next "big thing."On 8/20, we brought your attention -- albeit briefly -- to a small beverage company called Hansen (HANS):

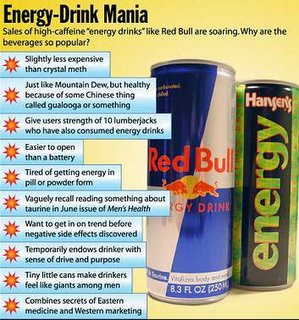

Hansen is a maker of sodas, juices, iced teas and smoothies. You've probably never heard the name, but most likely you have seen (or tasted) their products -- HANS makes the Monster Energy drink. We're long the stock with a hold recommendation.Shares have shot up to $72 from $43 (for a 67 % gain) since we first swayed readers to look at "the small cap company" trading at a "slight premium to the S&P. "

The Street thinks HANS may be the next Coke or Pepsi.

We know that sounds ridiculous, but it's true.

We don't believe it either, so why'd we recommend the stock?

Because the one cardinal rule for making money on Wall Street is this: understand the art of perception.

On Wall Street, perceptions trump reality; get married to reality and you've just discovered a recipe for poverty.

Hansen has one of this year's sexiest stories -- explosive growth fueled by specialty drinks.

We were convinced investors would jump on Hansen because of its niche product.

In fact, you could even argue that Hansen's recent run-up is Wall Street's way of making up for being unable to buy equity in Red Bull (which is privately held).

Cardinal rule #2: trends (especially those driven by youth) spell opportunity.

Chase niche, in other words.

Urban Outfitters (URBN), Hansen (HANS), Cutera (CUTR), Claire's (CLE), and Whole Foods (WFMI) -- besides all being on our buy list, what else do they have in common?

They all serve under-served markets. And their share prices have humiliated the returns posted by the S&P this year.

But understand: Niche is ephemeral and more often than not, whim-driven.

Citigroup analyst Gregory Badishkanian sticks to his $88 price target for HANS.

He claims this is a "new age/healthy lifestyle" beverage company.

Last time we checked, there was nothing healthy about sugar doused drinks.

Hansen, which just announced a buyback, could crash to the ground on any whisper of bad news.

On a recent conference call, Hansen's CFO said: ""You know, the future is uncertain. We don't know where it is all going to go."

We're advising readers to lighten up on holdings.

If there is any hint of any slowdown in coming quarters or any research report, this stock will surely crash.

With just 22 million shares outstanding -- a small float, indeed -- Hansen's less faithful would ditch it in a heartbeat.

By then, reality would've kicked in.

<< Home