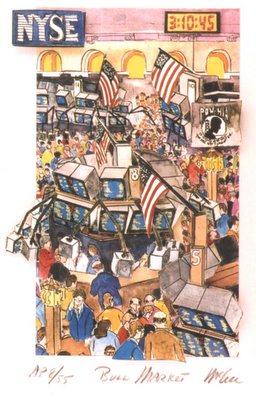

No Bull: 4Q Rally For Real, Kids

Like a basketball game that has you glued you to the TV, the market has demonstrated that the 4th quarter is where the party is at.

Like a basketball game that has you glued you to the TV, the market has demonstrated that the 4th quarter is where the party is at.Following a dry October, the market has delivered nothing but four weeks of solid gains.

The perennial Santa Claus rally was something we called out on more than one occasion.

Even when the Dow dropped to 10,220 (today the Dow is at 10,800) we remained bullish on stocks.

For example, on 9/24, we berated a negative report put out by Merrill Lynch's David Rosenberg:

Rosenberg pointed out in a Friday dispatch that we're witnessing an event that has happened barely more than 15% of the time in the past five decades: a year that sees the Fed tighten (liquidity pinch), oil prices rise (margin and personal-income squeeze) and the equity market head lower (wealth effect, discount mechanism) -- a triple play. The problem with this triple play theory is that it makes perfect sense. But it won't be validated by the end of year rally we're expecting for stocks.Let the truth be told -- On 10/1, we threw restraint out the window:

How can you not be bullish? Don't go anywhere -- the fourth quarter should be all fireworks as the Katrina recovery gets underway, Christmas-minded investors do their perennial quadrille, and traders start preparing for a Greenspan-less 2006.And in a piece called "Lehman Bros are Wimps" published 9/6, we took the bond bank head on:

"...frailty blamed on Kartrina forced Lehman Bros to cut back their equity weighting on Tuesday -- Wimps! The US stock market is a resilient beast. Important lows in stock prices are often accompanied by specific, cataclysmic events in the economy or in world affairs. These events serve to crystallize bearish sentiment. Ultimately, these events are good for the market -- they shake out the weak and frail. The media talks about reduced GDP growth, high and rising gasoline prices, and so on. Is the market dropping? The answer is a resounding no. Katrina will create jobs and awaken the dormant investor who forgot stocks are the best asset class in which to invest.The market is healthy and will remain healthy because energy prices are stabalizing, Greenspan's leaving office, and inflation jocks are finally chilling out.

Our prayers go out to all those who doubted this market: Forgive them father for they know not what they do.

<< Home